Business

How Rent-To-Own Programs Can Help You Achieve Your Dream Home

A rent-to-own contract can help buyers with credit issues or paying off debt get a mortgage. Many rent-to-own agreements set a purchase price for the property upfront. This is usually based on the home’s current or projected future value.

They Give You Time to Build Credit

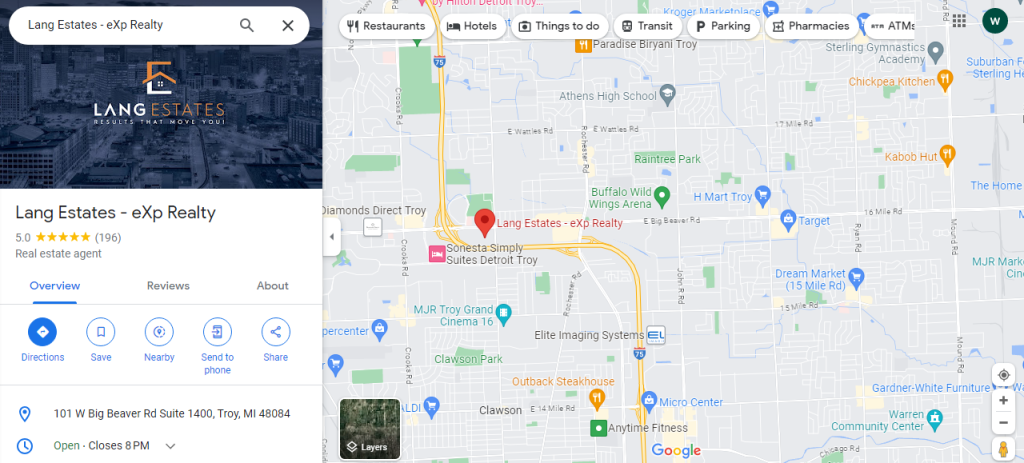

Homeownership is a big part of the American dream. However, it is becoming increasingly more work for many people to meet the financial requirements for a mortgage immediately. Rent-to-own programs allow you to get into a home and begin building credit while saving for a down payment. Some programs offer an option to purchase at the end of the lease period, and some may credit a percentage of your monthly rental amount toward the final home purchase price. Institutional rent-to-own companies like Lang Estates are usually more consumer-friendly than individual sellers or landlords because they must adhere to strict regulatory requirements. This includes having clear contracts, disclosures and consumer help resources. If you decide to rent-to-own, ensure your contract specifies your property’s maintenance and upkeep responsibilities. It is also important to consider how much you will pay in option fees or rent credit if you do not ultimately buy the property. Then you can decide if a rent-to-own program is the best option.

They Help You Achieve Your Dream

Homeownership is a quintessential part of the American dream, but it’s becoming increasingly difficult. If you’re not quite ready to apply for a mortgage or have yet to save enough for a down payment, rent-to-own programs could help you turn your dream into a reality. Some rent-to-own contracts even allow tenants to direct a portion of their monthly rental fees toward the property’s purchase price. Over time, this can add up to a sizable down payment you may have struggled to save otherwise. Before jumping into a rent-to-own agreement, please read the fine print and make sure it makes financial sense. Also, work with a knowledgeable real estate attorney to fully understand your contract’s terms. It’s also important to know your responsibilities regarding maintenance, as some agreements may specify that the tenant is responsible for property costs while renting. It can be challenging to save enough money for a home down payment, especially when paying higher rent premiums than the market rate. A lease-to-own option in Independence Township, MI, may help you avoid this hurdle by allowing you to build up the down payment over one or more years of rental prices.

They Help You Save for a Down Payment

A rent-to-own contract allows you to save for a down payment over time instead of all at once. It typically requires you to pay an upfront fee — known as an option fee — and a portion of your monthly rent goes toward a future home purchase. For example, a rent-to-own program purchases homes and leases them to participants for 12 months while helping them improve their credit scores and mortgage savings. The company puts 10% of each month’s rent toward the final purchase during this time. In addition to helping you build equity, it can allow you to see if you like a neighborhood before committing. The program also allows you to cancel your agreement without penalties if you cannot qualify for a mortgage. This may help you avoid the stress of foreclosure and loss of your deposit.